About Cable Bahamas

Cable Bahamas is the Caribbean’s telecommunications trailblazer, connecting people and communities with exceptional service. With approximately 850 employees across multiple companies, they have built a reputation for staying ahead of the curve. Their HR and payroll practices were already well-established, ensuring efficiency and compliance. However, as an innovative leader, Cable Bahamas saw an opportunity to do even more. By transitioning to an all-in-one people management solution, they aimed to elevate their internal operations, streamline processes, and empower their teams to achieve greater outcomes.

Key Results at a Glance

The Challenge

Workzoom has truly stepped up our game. Payroll runs seamlessly, and HR processes are no longer a tedious grind.

It’s simplified how we work, allowing us to focus more on our people. It’s been a complete game-changer for us.

Shanika Pinder

Compensation & Payroll Supervisor, HR Business Partner

The Solution

Cable Bahamas partnered with Workzoom to transform their HR and payroll processes, ensuring their team had the tools they needed to succeed. With a small but dedicated team of just three payroll professionals managing operations for all 850 employees, efficiency and accuracy were critical. Workzoom’s all-in-one platform made life simpler, smarter, and more efficient for everyone involved.

Workzoom at Cable Bahamas: A Game-Changer

In a recent webinar, Shanika Pinder talks about how Cable Bahamas uses Workzoom to simplify HR and payroll for a team of 850 employees. Learn about their path to wins in acheiving smoother processes.

Moving to Workzoom was the right move.

It allowed our dynamic report and payment structures the flexibility we needed… at the right price too!”

Patrick Fernander

Director of Compensation, Benefits, and Accounts

Smarter Payroll Processing

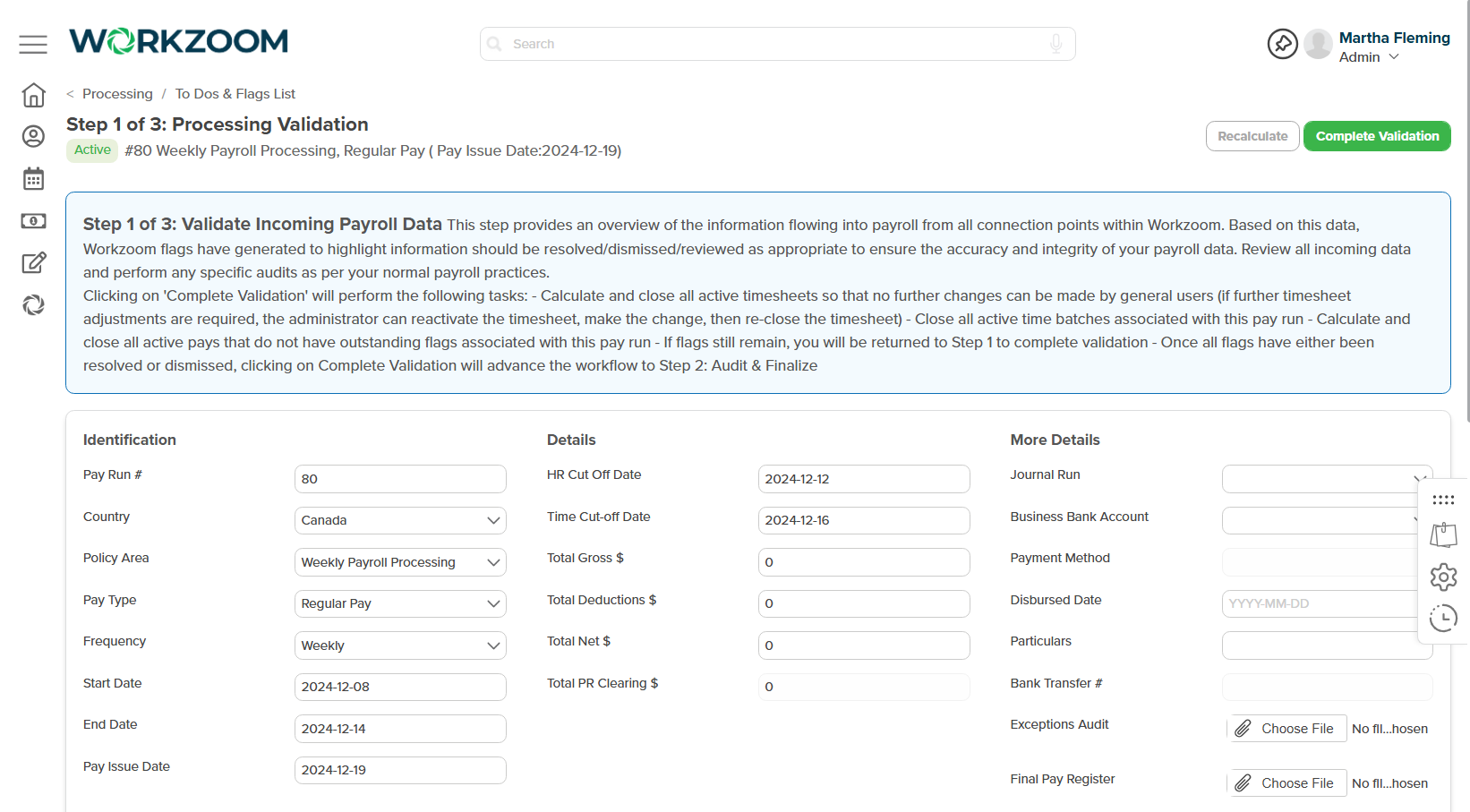

1. Processing Validation: Begin by reviewing critical payroll data such as hours worked, overtime, and leave. Workzoom automatically checks this information against Bahamian labor laws and National Insurance Contributions rates, ensuring accuracy right from the start.

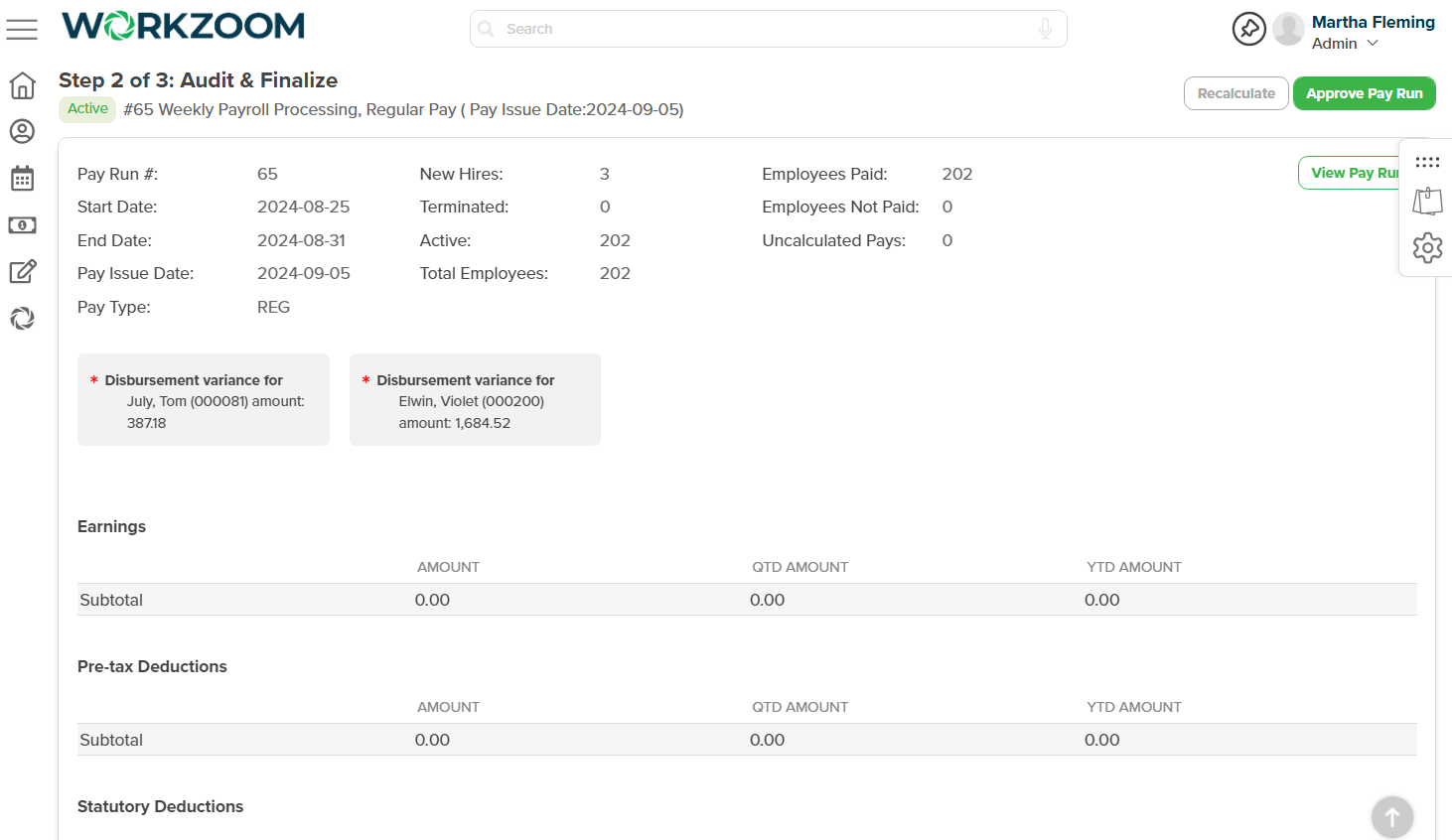

2. Audit & Finalize: After validations, review a Pay Run Summary. For detailed checks, use the Excel-based register to spot and resolve discrepancies. Easily make adjustments by reactivating a pay entry, editing as necessary, and saving updates. A “Recalculate” feature confirms all changes are applied before finalization.

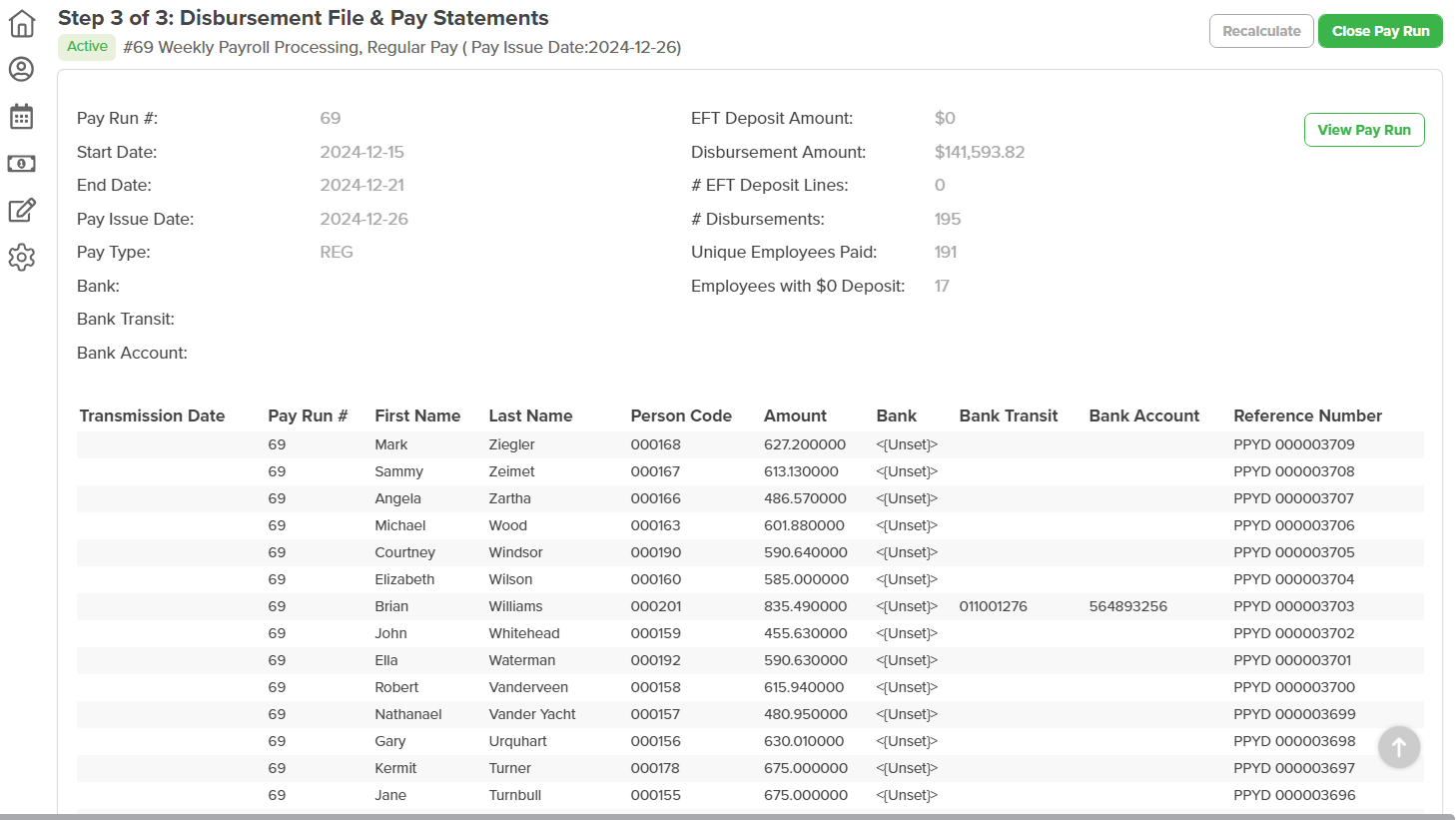

3. Disbursement File & Pay Statements: The last step includes a thorough review of the EFT summary using an Excel-based audit tool. Make any last-minute changes and finalize the disbursement file to ensure accuracy. Once verified, the payroll is securely and compliantly disbursed.